Chevron 2025: More Barrels, Less Profit, And A Bigger Cash Machine

- ohaiat

- לפני 3 ימים

- זמן קריאה 6 דקות

Chevron’s 2025 financials tell a subtly different story from 2024: volumes hit records and free cash flow jumped, but headline earnings fell as lower oil prices and weaker affiliates weighed on the bottom line. For investors, the interesting part is how the company used that backdrop to reinforce, rather than retreat from, its cash‑return playbook

1. 2025 In A Nutshell: Earnings Down, FCF Up

For the full year 2025, Chevron reported earnings of 12.3 billion dollars, down from 17.7 billion the year before. On an adjusted basis, earnings were 13.5 billion dollars, still below 2024 but better than the headline number implies. The main headwind was roughly 15% lower oil prices, compounded by lower affiliate income and adverse foreign exchange, only partly offset by stronger refined product margins and higher sales volumes.investing+2

The twist is on the cash side. Chevron highlighted that adjusted free cash flow rose by about 35% year‑on‑year, despite the softer price deck. More efficient capital spending, record production, and working capital movements combined to expand the cash pool available for dividends and buybacks even as accounting earnings declined. That’s the core 2025 message: the company became a better cash generator in a worse price environment.

2. Upstream: Record Production In A Lower‑Price World

Upstream remained the economic engine of the group, but it had to work harder for every dollar of profit. Across 2025, Chevron delivered record production, surpassing 4 million barrels of oil equivalent per day in the third quarter and maintaining elevated levels into year‑end. This built on the 7% production growth the company had already achieved in 2024, when net oil‑equivalent output reached roughly 3.3 million barrels per day, including strong contributions from the Permian Basin.

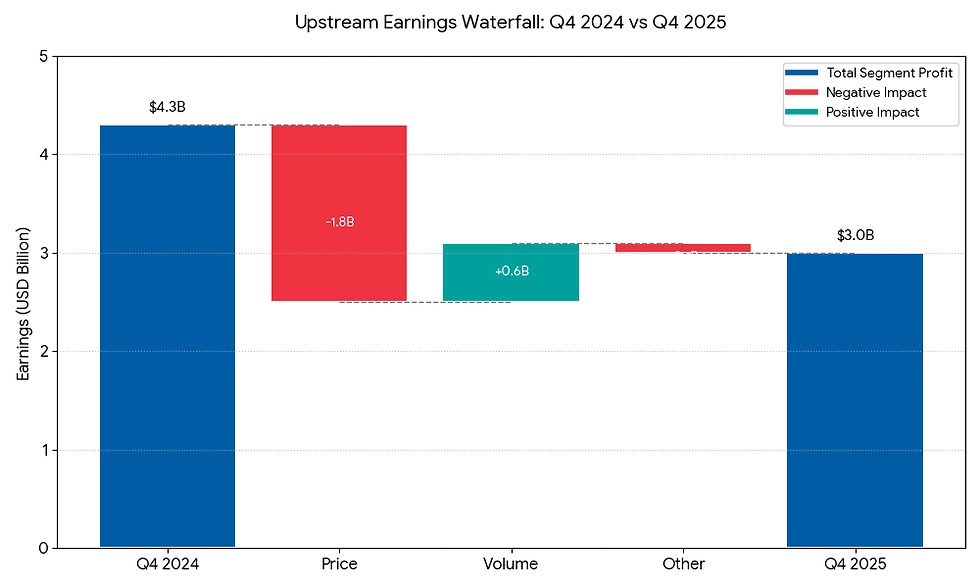

However, lower commodity prices bit into earnings. In the fourth quarter of 2025, upstream segment profit was about 3.0 billion dollars, roughly 30% below the 4.3 billion earned in the prior‑year quarter. The full‑year decline in upstream earnings versus 2024 reflects that same squeeze: more barrels flowing through the system, but each barrel earning less. It’s a textbook demonstration of Chevron’s upstream model—capital‑heavy assets that can deliver volume growth and underpin cash generation, but whose profitability remains tightly tethered to the commodity

3. Downstream: From Drag To Support

.

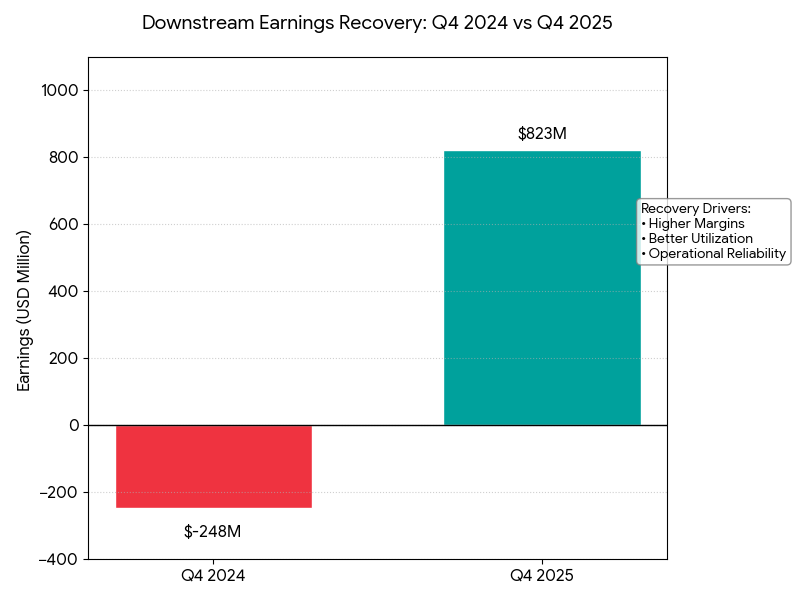

If 2024’s FS showed downstream as a major weak spot, 2025 looks more like a repair job. Refining and marketing benefited from higher refined product margins and better utilization, reversing some of the damage done when margins compressed and U.S. downstream earnings collapsed the year before. In the fourth quarter of 2025, downstream earned 823 million dollars, a sharp turnaround from the 248 million loss booked in Q4 2024.

That swing underscores the role downstream plays in Chevron’s portfolio. On the income statement, refining and marketing still drive a large share of group revenue, but their earnings contribution can vary wildly with margin cycles, operating costs and throughput. In 2025, stronger product margins and increased volumes meant downstream shifted from being a drag on group profitability to a partial offset to upstream’s price‑driven earnings decline. It is still a structurally lower‑return, more volatile business than Chevron’s best upstream projects, but in 2025 it did its job as a cyclical counterweight.

4. Capital Allocation: Record Returns, Again

The most striking part of Chevron’s 2025 story is what it did with its cash. For the second year in a row, the company returned a record 27 billion dollars to shareholders. This time, the mix tilted a bit more toward dividends: about 12.8 billion dollars paid out, alongside 12.1 billion in share repurchases. On top of that, Chevron spent around 2.2 billion dollars acquiring Hess common stock in the first quarter, advancing its strategic push into Guyana and other high‑quality assets.

Quarterly cadence reinforces how aggressively management leaned into capital returns. In Q4 alone, Chevron distributed 3.4 billion dollars in dividends and 3.0 billion in buybacks. That all came while funding organic capital expenditures of about 5.1 billion dollars in the quarter and maintaining a strong balance sheet. The picture that emerges is clear: even with lower oil prices and reduced reported earnings, Chevron prioritized returning essentially all of its surplus cash to shareholders, using the balance sheet and disciplined capex to keep that promise credible.

5. What 2025’s FS Say About Risk And Resilience

Read alongside 2024, the 2025 financial statements sharpen the view of Chevron’s risk profile and resilience.sec+2

Commodity exposure remains central. Lower oil prices were the single biggest reason earnings fell from 17.7 to 12.3 billion dollars year‑on‑year, despite record production. Upstream can offset some price weakness through volume and efficiency, but it cannot fully escape the

Portfolio balance is working, but fragile. Downstream moved from hurting to helping the P&L as refined product margins improved, yet its profitability remains highly sensitive to spread and cost dynamics.stock-analysis-on+2

Cash discipline is now the main defence. The fact that adjusted free cash flow grew 35% in a weaker price environment shows how important capex efficiency and working capital management have become to Chevron’s story. It’s that discipline, combined with a conservative balance sheet, that allows the company to sustain record‑level cash returns even when reported earnings are under pressure.investing+1

Put differently, 2025 confirms that Chevron is evolving into a “cash‑first” hydrocarbon business: one that accepts intrinsic earnings volatility but works to stabilize what ultimately matters to shareholders—free cash flow and distributions.

6. How Chevron Stacks Up Against Its Peers

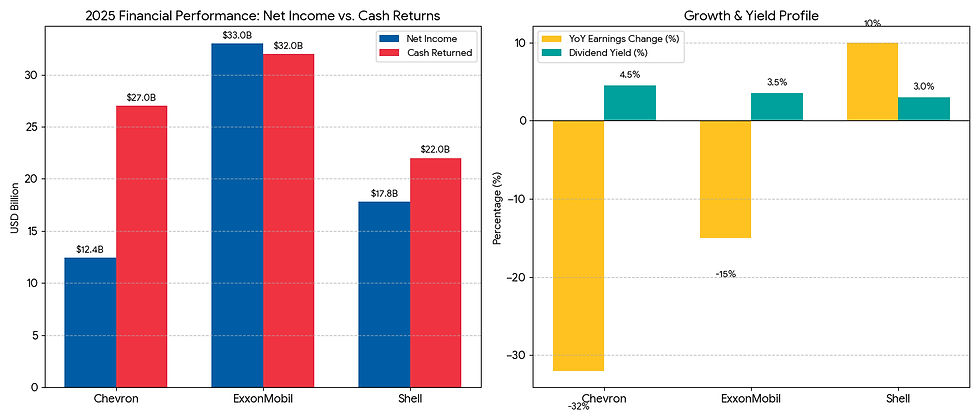

Looking across the 2025 numbers, Chevron sits in an interesting middle ground among the oil majors. Its earnings decline was steeper than peers like ExxonMobil and Shell, but its combination of dividend yield and capital returns remains one of the strongest in the sector. At the same time, Chevron’s production growth and U.S. upstream focus give it a distinct profile compared with more globally diversified or transition‑tilted competitors.

On profitability, ExxonMobil clearly had the stronger year. In 2025, Exxon’s full‑year earnings fell, but from a higher base and by a smaller percentage, while Chevron’s profits dropped about 32% to roughly 12.4 billion dollars on 189 billion of revenue. Shell, meanwhile, managed to grow earnings to 17.8 billion dollars on 273.7 billion of sales, despite modestly lower revenue, highlighting better resilience to lower prices and margins. Put simply, Chevron grew volumes and free cash flow, but peers showed more robust headline profitability.

Where Chevron looks more competitive is on cash returns and income. In 2025 it again returned about 27 billion dollars to shareholders, matching 2024’s record and putting it in the same league as Exxon on absolute capital returned. However, Exxon’s lower dividend payout ratio (around 30% versus Chevron’s ~70% range) and larger free cash flow base give it more buffer in a downside scenario, while Chevron offers the higher dividend yield—around 4.5% versus roughly 3.5% for Exxon going into 2026. Shell’s approach is different again: a 40–50% cash‑from‑operations distribution framework and heavy buybacks, but slightly lower absolute returns than the two big U.S. majors.

Strategically, Chevron’s edge lies in its low‑cost growth barrels, especially in the Permian and, post‑Hess, in Guyana. U.S. upstream production grew at roughly 5% year‑on‑year in early 2025, even as global upstream income fell on lower prices, underlining the resilience of its North American shale and deepwater portfolio. Exxon is pushing a similar low‑cost resource strategy with an even larger scale and an explicit ambition to reach 30‑dollar‑per‑barrel corporate breakevens by 2030, backed by aggressive cost cuts. Shell, in contrast, is leaning harder into structural cost reductions and a more balanced hydrocarbon‑plus‑transition path, with capex trimmed and distributions set as a share of cash flow rather than an absolute target.

7. How To Read Chevron After 2025

For an analyst or investor, 2025’s FS sharpen the thesis that was already visible in 2024. Chevron today is a high‑volume, upstream‑driven cash generator with a cyclical downstream arm and an uncompromising capital return agenda. The company delivered record production and materially higher free cash flow, while earnings fell and oil prices declined. It still sent 27 billion dollars back to shareholders and advanced a strategic acquisition that deepens its exposure to low‑cost, long‑life barrels.fintel+2

The key question looking forward is whether that combination—record volumes, disciplined spending, and aggressive cash returns—can remain sustainable if prices stay lower for longer or macro conditions deteriorate. The 2025 financials suggest that Chevron has more room than many to absorb such pressure, thanks to its cost base, portfolio depth and balance sheet. But they also reinforce that this is still a business tied to a volatile commodity system. The bet embedded in the 2025 numbers is clear: Chevron believes it can turn that volatility into a durable, attractive yield for shareholders. Whether that bet pays off will depend not just on execution, but on how the next phase of the energy cycle—and the energy transition

תגובות