Hulliburton - Company Analysis

- ohaiat

- לפני 34 דקות

- זמן קריאה 14 דקות

Executive Summary

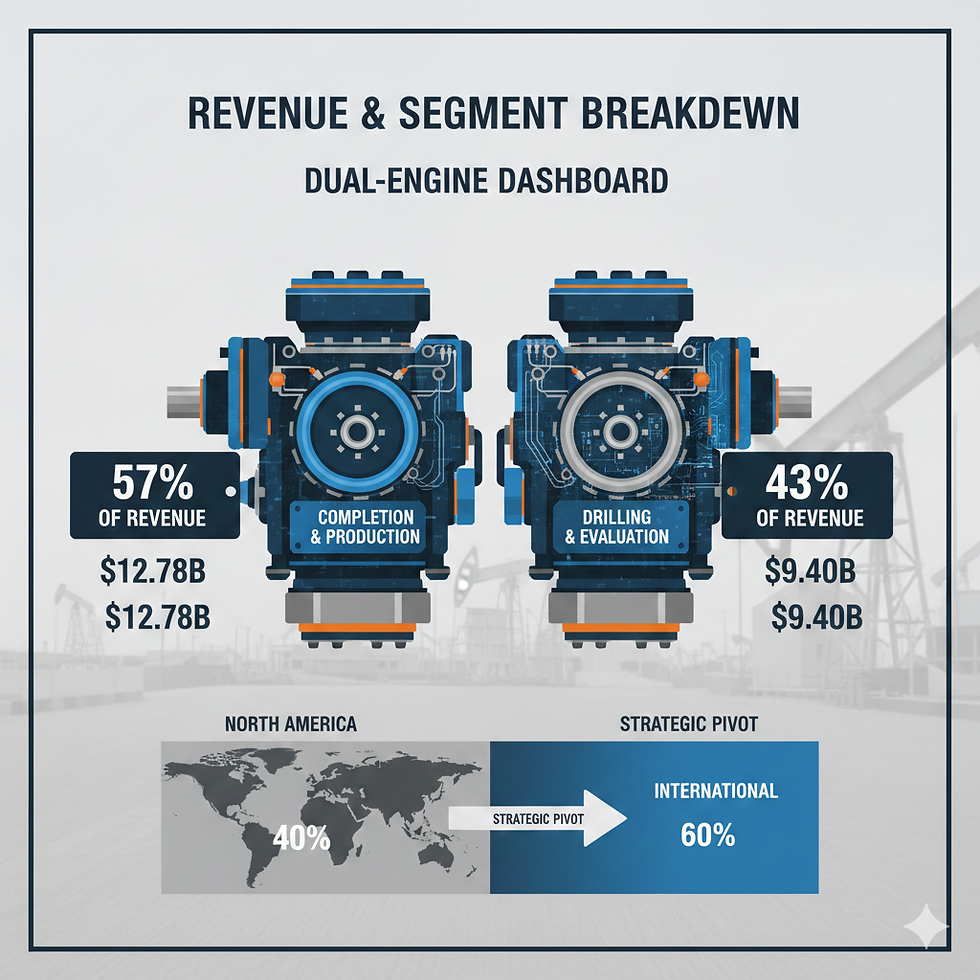

Halliburton is increasingly positioning itself as a returns‑focused oilfield services platform: still highly leveraged to short‑cycle North American completions, but with its future economics tied more to international, technology‑driven growth and tight capital discipline. From 2023 to 2025, revenue eased only modestly, but reported operating income fell more sharply due to heavy 2025 impairments and charges, masking still‑solid mid‑teens underlying segment margins and strong free cash flow that funded both debt reduction and about $1.6B of shareholder distributions. The core Completion & Production business remains the main earnings engine and source of cyclicality, while Drilling & Evaluation provides a steadier, technology‑weighted counterbalance, especially in international and offshore markets. Strategically, Halliburton’s growth plan rests on reweighting toward international and offshore, embedding digital and AI across its service lines, and building energy‑transition‑adjacent options, all underpinned by a more disciplined capex and cost structure aimed at making a historically boom‑bust franchise structurally more cash‑generative through the next cycle.

Background

Halliburton Company is one of the world’s largest oilfield services providers, selling the tools, technology and expertise that exploration and production (E&P) companies need to find, drill and complete wells rather than owning reserves itself. Founded in 1919 and now headquartered in Houston with a major base in Dubai, it operates in more than 70 countries and sits squarely in the upstream part of the value chain, alongside peers like SLB and Baker Hughes. Over the decades Halliburton has cycled through phases of diversification into engineering and construction and then back to a tighter focus on core oilfield services, but the investment case has always been the same: this is a geared way to express a view on global drilling and completion activity.

That positioning comes with structural pros and cons. On the one hand, Halliburton does not carry the long‑dated geological and political risks of owning reserves; it earns fee‑based revenues tied to customer capex, often with faster paybacks and less direct exposure to spot commodity prices. On the other hand, when E&P spending turns down, the service providers are usually hit first and hardest, as utilization falls, pricing erodes and heavy equipment fleets sit idle. The company’s history through the shale boom, the 2014–2016 bust and the 2020 pandemic downturn illustrates how brutally cyclical this model can be, but also how powerful the operating leverage is on the way up.

Today Halliburton presents itself as a returns‑focused, technology‑intensive services platform rather than a volume‑at‑any‑price contractor. Management’s messaging stresses capital discipline, higher structural margins, and a deliberate tilt toward international and offshore markets, where activity is driven by multi‑year development programs instead of quarter‑to‑quarter changes in U.S. rig counts. That shift in emphasis is central to understanding both its recent financial performance and the way it is trying to manage risk heading into the next leg of the energy cycle.

Revenue streams: segments and geography (through 2025)

Halliburton organizes its business into two main reporting segments: Completion and Production (C&P), and Drilling and Evaluation (D&E). C&P covers pressure pumping, hydraulic fracturing, completion tools, cementing and a range of production enhancement services—essentially the work required to bring a drilled well onstream and then keep it producing. D&E, by contrast, spans drilling services, measurement‑ and logging‑while‑drilling, wireline, testing, and subsurface software and digital solutions that help customers design and construct wells and understand reservoirs.

Financially, C&P is the larger of the two engines. In 2025 Halliburton generated roughly $22.2B of revenue, down slightly from $22.9B in 2024, as both North America and international markets softened. Operating income fell to $2.3Bfrom $3.8B the prior year, largely because 2025 included about $831M of impairments and other charges versus $116M in 2024. Excluding these items, adjusted operating income was about $3.1Bin 2025 compared with $3.9B in 2024, reflecting lower activity and pricing in North America and modest international weakness but still solid underlying segment profitability. For 2025, Completion & Production and Drilling & Evaluation delivered operating margins of roughly 17% and 15%, respectively, underscoring that both segments remained profitable despite the top‑line and charge‑related pressure.

By geography, North America still dominates at around $9.6Bof revenue in 2024 (about 42% of the total), but the combined international footprint now makes up close to 60%, with Middle East/Asia the largest international region at roughly $6.1B, followed by Latin America at about $4.2B and Europe/Africa/CIS at around $3.0B . In 2025 total revenue slipped 3% , with international revenue down about 2% and North America down roughly 6%amid lower U.S. land activity and rig counts. The mix, however, still skewed toward international, reinforcing management’s strategic shift away from a purely North‑America‑driven model.

2025 results underscore both the opportunity and the vulnerability embedded in this revenue structure. In the fourth quarter Halliburton delivered about $5.7B of revenue, broadly flat year on year, with a reported operating margin of roughly 13% and an adjusted operating margin around 15% . For the full year, revenue declined modestly, but segment operating margins in C&P and D&E held up at 17% and 15% thanks to pricing and cost discipline, even as North American activity and pricing softened. For an investor, the picture that emerges is of a company whose earnings power is dominated by C&P and by North America, but whose incremental growth and resilience increasingly depend on international markets.

The C&P segment gives Halliburton high short‑cycle torque to North American completions and unconventional, where activity can ramp quickly and pricing moves with capacity tightness. D&E, especially in international and offshore markets, tends to be steadier and more technology‑driven, with multi‑year contracts and digital subscriptions that smooth earnings. Together they give Halliburton a barbell between volatile but high‑upside North American completions and a more durable international drilling and evaluation franchise.

Cost structure and operating leverage

Halliburton’s cost base reflects its identity as a capital‑ and labor‑intensive services platform rather than an asset‑light software company. The bulk of its operating expenses comes from people, pressure‑pumping and drilling fleets, maintenance, consumables such as sand and chemicals, fuel and power, and the logistics required to move equipment and crews to customer locations. In C&P, costs are especially skewed toward fleet‑related expenses and consumables, because every frac job consumes proppant, fuel and equipment life; in D&E, the cost stack skews more toward highly skilled labor, technology, and the upkeep and depreciation of sophisticated downhole tools and software.

This mix gives Halliburton significant operating leverage in both directions. When activity and pricing improve, labor and equipment can be spread over more revenue, so margins expand quickly; when utilization falls, the same semi‑fixed costs weigh heavily on earnings, particularly in C&P, where under‑utilized fleets still need to be staffed, stored and maintained. Management’s recent restructuring moves are aimed squarely at this problem: the company has been “right‑sizing” its footprint, cutting overhead and streamlining operations, targeting on the order of $100M of quarterly labor cost savings while defending service quality. That helps explain why Halliburton has been able to sustain mid‑teens operating margins even as North American revenue has softened and overall top‑line growth has flattened. The impact of that cost work shows up in 2025: even with a 3 percent revenue decline and sizable impairments and charges, the core C&P and D&E segments still posted mid‑teens operating margins and generated strong cash flow, which is only possible if the company is structurally lowering its fixed‑cost burden.

Capital expenditure and investment strategy

Halliburton’s business model requires ongoing capital expenditure to build, refresh and technologically upgrade its fleets and tools, but management is increasingly explicit that it will not chase growth at any price. Historically, large chunks of capex went into new pressure‑pumping equipment, drilling tools and support infrastructure, particularly to serve North American unconventional. The new posture is more disciplined: capital spending is being held to a tighter envelope, with planned capex around a lower, roughly 1‑billion‑dollar range in the coming years, representing a reduction of nearly 30% versus prior plans. That lower capex intensity, combined with healthier margins, is one of the main engines of free‑cash‑flow generation.

The 2025 numbers put those intentions into practice. Halliburton generated about $2.9B of cash flow from operations and kept capital expenditures to roughly 6% of revenue, allowing it to produce robust free cash flow despite the earnings hit from impairments and softer activity. Management used that cash to retire approximately $382M dollars of notes due November 2025 and to return around $1.6B to shareholders through dividends and share repurchases, reinforcing the message that disciplined capex and capital returns, not fleet growth, are now the core of the equity story.

Within that smaller capex bucket, the mix is shifting toward higher‑return and more strategic uses. Halliburton is prioritizing investments that either improve asset efficiency—such as upgraded frac fleets and digital control systems that deliver more stages per day at lower cost—or that deepen its moat with technology and data, like AI‑driven optimization platforms and cloud‑based subsurface software. It is also directing capital and R&D into international infrastructure and into adjacencies tied to the energy transition, including geothermal, lithium extraction and emissions‑management solutions. The underlying idea is to treat basic fleet growth in oversupplied basins as a low‑priority use of cash and instead concentrate spending where it can lift structural margins or open new growth avenues. In the current strategy, disciplined capex is not just a financial metric; it is the bridge between cyclically volatile earnings and a more cash‑generative equity story, funding dividends and buybacks without over‑levering the balance sheet.

Business models, profitability and growth

Completion & Production: short‑cycle torque, margin sensitivity

The C&P segment is built around equipment‑ and service‑intensive offerings whose economics are dominated by utilization and pricing. Halliburton earns revenue through job‑based service fees and sales of completion equipment such as frac systems, tools and cementing hardware, often under master service agreements or regional contracts but with meaningful exposure to spot activity levels and competitive capacity. In practice, this means the business can swing from loss‑making in deep downturns to very attractive margins in tight markets when fleets are fully utilized and customers are more willing to pay for performance and integrated offerings.

Coming out of the 2020 trough, C&P has led Halliburton’s recovery. As North American shale activity rebounded and international completions accelerated, C&P revenues and margins expanded sharply, driving most of the company’s 13 percent year‑on‑year revenue growth in 2023. In the third quarter of 2024, however, the flip side of that cyclicality showed up: C&P revenue dipped to $3.3B, down 3%sequentially, and operating income fell 7%to $669M, driven by weaker pressure pumping in U.S. land and lower completion tool sales in North America and parts of Europe/Africa, only partly offset by stronger activity in the Middle East. That pattern continued into 2025 as North American customers pulled back, with lower U.S. land activity and rig counts weighing on revenue and adjusted operating income, even though the segment still posted a healthy 17% operating margin for the year. The underlying business model remains capital‑intensive and cyclical, and investors should expect earnings volatility in line with E&P spending in key basins.

Looking forward, the C&P growth story is less about volume and more about mix and technology. Halliburton is investing in intelligent frac systems, automation and digital optimization—such as its SmartFleet intelligent fracturing system—to help customers improve recovery and lower per‑barrel costs. If the company can maintain pricing on differentiated services, push more integrated packages, and continue to shift the revenue mix toward international and offshore completion campaigns, C&P has room to deliver attractive returns even if North American activity is flattish.

Drilling & Evaluation: technology‑driven, international skew

D&E’s economics are built less on fleet utilization and more on intellectual property, service quality and long‑term relationships. The segment provides drilling services, measurement‑ and logging‑while‑drilling, wireline, testing, reservoir evaluation and software platforms that are embedded in customers’ workflows. Many of these offerings are sold under multi‑year contracts, integrated project management arrangements or subscription models, which can cap upside in the very strongest markets but provide resilience when conditions weaken.

In recent years D&E has benefited from the recovery in offshore and international activity. As national oil companies and majors ramp long‑cycle development projects, demand for complex drilling services, evaluation and digital subsurface tools has grown, and Halliburton has leaned into this with a push on digitalization and integrated well construction solutions. While D&E remains the smaller of the two segments by revenue, its contribution to margin stability is increasingly important: in 2025 it delivered a 15% operating margin despite the broader slowdown, acting as a ballast against C&P’s volatility. As more customers adopt cloud‑based platforms and AI‑driven optimization tools, there is scope for D&E’s margin structure to improve over time through higher‑value software and analytics layers rather than purely service‑hour growth.

Corporate economics and capital allocation

Roll the segments up and Halliburton’s recent financial profile still looks markedly better than in prior downcycles, even though 2025 was clearly a tougher year. With about $22.2B of revenue and $2.3B of reported operating income—including $831M of impairments and other charges—the company still turned in healthy underlying economics. On an adjusted basis, operating income of roughly $3.1B implies mid‑teens adjusted operating margins, supported by segment margins of 17% in Completion & Production and 15% in Drilling & Evaluation. Those margins, in turn, funded strong cash generation and ongoing shareholder distributions even as volumes and pricing in North America came under pressure.

Capital allocation is central to the narrative. In 2025 the company held capital expenditures to about 6 percent of revenue, executed restructuring and “right‑sizing” moves that contributed to maintaining segment margins, and still returned roughly $1.6Bto shareholders while reducing debt. At the same time, it continued to redeploy capital and R&D into higher‑return initiatives: international expansion, digital platforms, AI‑driven efficiency tools, and energy‑transition‑adjacent businesses such as geothermal and lithium extraction where its subsurface expertise is directly applicable. The implicit promise to investors is that Halliburton can convert a historically boom‑bust services franchise into a more cash‑generative platform by holding the line on capex, growing higher‑margin digital and international revenues, and treating North America as a cash cow rather than a growth engine.

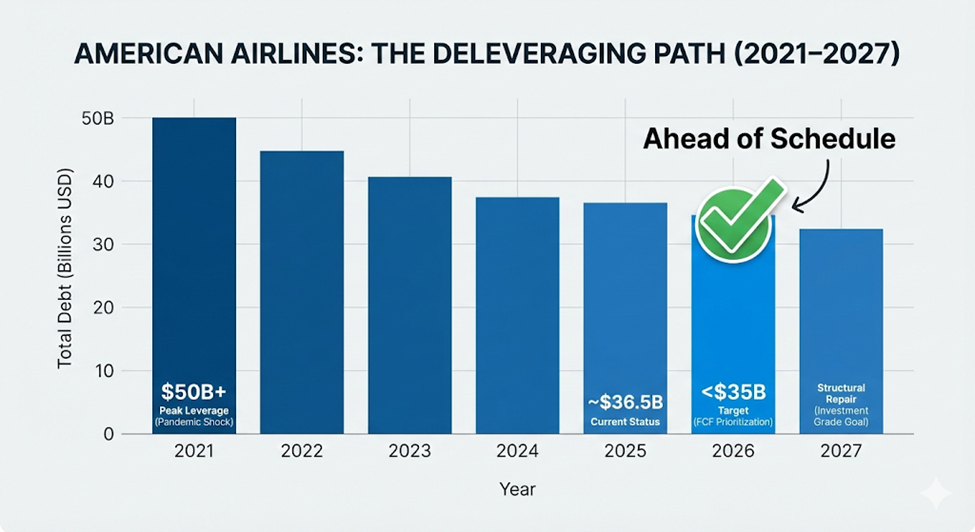

Balance sheet and financing

On the financing side, Halliburton runs a fairly conventional oilfield‑services balance sheet built around unsecured term debt, a revolving credit facility and access to the bond markets. The company aims to keep leverage at a moderate multiple of EBITDA and to ladder its maturities so that no single year presents a destabilizing wall of refinancing risk. In recent years, strong operating cash flow has allowed Halliburton to fund capital expenditures, pay a regular dividend and repurchase shares while still maintaining comfortable liquidity and working down pockets of higher‑cost debt. Interest expense remains manageable relative to operating income, so the income statement is still driven primarily by operating performance rather than by the cost of financing.

2025 results show that strategy in action: the company generated roughly $2.9B of operating cash flow, kept capex constrained, retired $382M of debt and still returned about $1.6B to shareholders, all while absorbing substantial impairment and restructuring charges. Strategically, management treats balance‑sheet strength as a competitive asset in a cyclical industry. Maintaining an investment‑grade‑like profile and ample liquidity helps Halliburton weather downturns without fire‑sale asset disposals or dilutive equity raises, and it reassures large international customers that the company can stand behind multi‑year contracts and complex, integrated projects. The financing structure also gives Halliburton the flexibility to keep investing through the cycle - into technology, international capacity and selective M&A - rather than pulling back to preserve cash at precisely the moment when weaker competitors are forced to retreat. That combination of moderate leverage and ample access to capital markets is a key part of how the company tries to balance its inherently levered exposure to upstream spending with a more resilient financial profile.

Risk map and how Halliburton manages it

Halliburton’s opportunity set is inseparable from its risk profile. The most obvious risk bucket is macro and commodity‑linked: customer spending is a derived demand on oil and gas prices, and downturns in crude or gas can quickly translate into lower rig counts, fewer wells, and intense price competition for services, especially in North America. The recent pattern—international revenues holding up better while North America declines on weaker activity—shows how quickly regional softness can undercut growth even when global demand is reasonably healthy. If OPEC+ policy, recession risks or price shocks trigger a broader capex pullback, Halliburton’s earnings would feel the impact, particularly in its most cyclical C&P offerings.

Geographic and geopolitical exposure form the second major risk pillar. Operating in more than 70 countries exposes the company to political instability, sanctions, conflicts, and regulatory changes, including in high‑profile regions such as the Middle East, Russia and Latin America. Exits from sanctioned markets, disruptions from conflicts, and abrupt shifts in local content or tax regimes can all lead to revenue loss, stranded assets or impairments - as highlighted by roughly $831M of impairments and other charges recorded in 2025 versus $116M the prior year. Against that backdrop, Halliburton has formalized an enterprise risk management (ERM) framework that identifies, assesses and monitors enterprise‑level risks, with board‑level oversight and integration of risk considerations into strategy and business continuity planning.

Regulation, ESG and the energy transition are the third key risk category. As a company whose core business is enabling hydrocarbon production, Halliburton faces long‑term uncertainty around climate policy, environmental regulation of fracking, emissions rules and investor pressure on carbon intensity. Stricter rules on water use, sand, methane and local environmental impacts can raise costs or constrain operations in specific basins, while a faster‑than‑expected shift toward low‑carbon energy could eventually dampen global upstream capex. The company’s response has been two‑fold: first, to improve the environmental performance of its core offerings through more efficient equipment and digital optimization; second, to build optionality in energy‑transition‑aligned areas such as geothermal, lithium extraction, carbon capture and emissions management software, often via partnerships and ventures like Halliburton Labs and joint ventures around Envana emissions platforms.

Finally, there are operational and financial risks typical of a capital‑intensive services group: underutilized fleets in downturns, supply chain disruptions, cyber risks, FX swings and the potential for cost inflation to squeeze margins if pricing lags. In 2025 Halliburton also absorbed about $89M of incremental tariff expense and continued to deal with the aftermath of a material 2024 cybersecurity incident, illustrating how regulatory and cyber risks can translate into tangible costs alongside more traditional commodity and geopolitical shocks. Here again, the company’s playbook centers on cost discipline and flexibility. By cutting capex, optimizing its footprint, and executing labor and overhead reductions, Halliburton aims to lower its fixed cost base so that more of each incremental revenue dollar drops through to the bottom line, while also leaving itself enough balance sheet headroom to tolerate downturns and invest in strategic priorities. The strategic emphasis on international and offshore markets, digitalization of the core, and scaling lower‑carbon adjacencies is itself a risk‑management strategy: diversify away from the most volatile parts of the cycle and toward longer‑cycle, higher‑margin, and potentially more durable revenue streams.

How Halliburton stacks up versus peers

Against its closest peers, Halliburton remains the most completions‑centric and one of the most North‑America‑levered of the big three global oilfield service companies. SLB (Schlumberger) has a broader technology portfolio and a heavier weighting to Deepwater and international markets, spanning subsurface, subsea and production optimization, and so tends to trade as the more diversified, “global tech” champion of the sector. Baker Hughes combines a more conventional oilfield‑services business with a large turbomachinery and LNG equipment franchise, plus process‑industry exposure, which gives it a somewhat different cycle profile linked to large LNG trains and mid‑/downstream projects as well as drilling and completions.

Halliburton’s differentiation is its depth in completions and its long track record in North American unconventional, alongside a growing international footprint. Its C&P segment gives it unusually high torque to short‑cycle activity and pricing, especially in U.S. shale, which can drive outsized margin expansion early in an upturn but also sharper contractions when capacity loosens. SLB, by contrast, is more anchored in long‑cycle offshore and international work, with greater emphasis on subsurface technology and digital, so its earnings profile is typically smoother but less explosively geared to North American spot activity. Baker Hughes, with its LNG and turbomachinery businesses, has a different mix of risks and opportunities, participating in secular growth in gas infrastructure and industrial decarbonization alongside more traditional OFS. In that context, Halliburton is still the more torque‑y play on short‑cycle completions and North American unconventional, even as its strategic push into international markets and digital offerings gradually reduces that concentration risk and nudges it closer to the global, tech‑heavy model exemplified by SLB.

Management’s growth plan

Halliburton’s growth plan, as laid out in recent filings, investor materials and sustainability reports, rests on three main pillars. First, the company is leaning hard into international and offshore growth, where national oil companies and majors are committing multi‑year capital to complex development projects. Management highlights the Middle East/Asia and Latin America as the primary engines of expansion, with a focus on integrated well construction, completions and digital services that can increase recovery and efficiency for large resource holders. The aim is to have international markets contribute a rising share of revenue and earnings, smoothing the cyclicality of North American shale.

Second, Halliburton is betting on technology and digitalization to lift returns. The company is investing in AI‑driven optimization, cloud‑based subsurface platforms, automation and intelligent equipment to increase “revenue per rig” and “margin per well” rather than simply chasing more volume. By embedding software, data and analytics into its service lines, Halliburton hopes to create more recurring, higher‑margin revenue streams that are less tied to pure activity levels. Third, it is building optionality in energy‑transition‑aligned businesses. Through internal R&D, partnerships and ventures such as Halliburton Labs, the company is developing capabilities in geothermal, lithium extraction, carbon capture and emissions management software, positioning its core skills in subsurface engineering and project execution to stay relevant as the energy system decarbonizes.

In commenting on 2025 results, management stressed that, even in a year of lower revenue and heavy charges, international operations, technology differentiation and disciplined capital allocation allowed Halliburton to “exceed expectations” and deliver strong adjusted margins and cash returns, reinforcing that the growth plan is built around quality of earnings rather than headline growth. Put together, the plan is less about maximizing the next shale upcycle and more about compounding higher‑quality earnings: shift the mix toward international and offshore, layer on digital and AI to increase revenue and margin per well, and seed a portfolio of lower‑carbon adjacencies that can ride alongside hydrocarbons rather than compete with them. For investors, the key question is whether that strategy is enough to structurally lift margins and cash generation across the next cycle, and whether the pace of the energy transition leaves Halliburton enough runway to fully monetize its current portfolio while building the next one.

תגובות